I. Introduction

On November 2, 2020, the SEC’s Division of Enforcement issued its Annual Report for Fiscal Year 2020 and just two weeks later Jay Clayton confirmed that he would be ending his tenure as Chairman of the SEC at the end of this year.[1] In a year dominated by the COVID-19 pandemic, Chairman Clayton caps off his enforcement legacy with what could best be characterized as a year of mixed success. While the Enforcement Division brought several significant actions in nearly all areas of its program and collected record monetary fines, it nevertheless filed fewer enforcement actions than in any other year of Chairman Clayton’s tenure. Like the rest of the country, the SEC faced profound challenges to its operations during the pandemic, but the downward trend of the Commission’s enforcement activity predated the pandemic’s arrival to American borders. As in most years, the number of enforcement actions filed increased significantly in the back half of FY 2020, even as SEC staff adjusted to working remotely.

As in years past, the Commission has resisted too great a focus on annual metrics. Chairman Clayton said last month that, “while the Enforcement Division’s traditional statistics were – and continue to be – impressive, it is my view that we should take care not to fall into the mode of managing to the available data.”[2] Still, despite the late-year increase in activity, the SEC ended Fiscal Year 2020 with a significant decrease in enforcement activity compared to 2019. According to the Division of Enforcement, the Commission brought 405 “stand-alone” cases compared to 526 such cases last year. This amounts to a 23% decrease in enforcement matters over FY 2019, excluding delinquent filing cases and administrative follow-on cases. While the number of cases decreased, the SEC collected $3.589 billion in disgorgement and $1.091 billion in penalties, its highest-ever total recovery.[3]

Looking at Chairman Clayton’s tenure as a whole, the results are quite similar statistically to the tenure of Clayton’s predecessor, Mary Jo White. During Chairman Clayton’s tenure to date, the Commission has brought approximately 2,550 enforcement actions, obtained $14 billion in financial remedies, distributed more than $3.3 billion to harmed investors, and paid awards of more than $350 million to whistleblowers.[4] The number of actions brought under Clayton’s watch is slightly less than Chair White, where the Commission brought 2,850 enforcement actions, but the Clayton Commission recovered slightly more in financial remedies than the White Commission’s $13.4 billion and gave out significantly more money in whistleblower awards.[5] Giving Chairs Clayton and White equal credit for whistleblower awards in 2017, when they split the year as Chairperson, the SEC gave out $427 million in whistleblower awards during Clayton’s three and one-half year tenure as compared to $151 million in awards during Chair White’s last three and one-half years on the job. In its 2020 annual report, the Division of Enforcement attributes this year’s large increase in awards to an “increased . . . rate at which whistleblower claims were evaluated and awards were issued.”[6]

The election of former Vice President Joe Biden will likely lead to more enforcement activity, especially given the drop in activity this year. The next SEC Chairman may also have different enforcement priorities than Clayton, whose Commission has emphasized retail-oriented offering frauds over other types of misconduct. Particularly if the Republicans maintain their majority in the Senate, Clayton’s successor would be expected to be a moderate who would most likely make incremental, rather than sweeping, changes in the way the Enforcement Division conducts business.

II. 2020 Enforcement Results

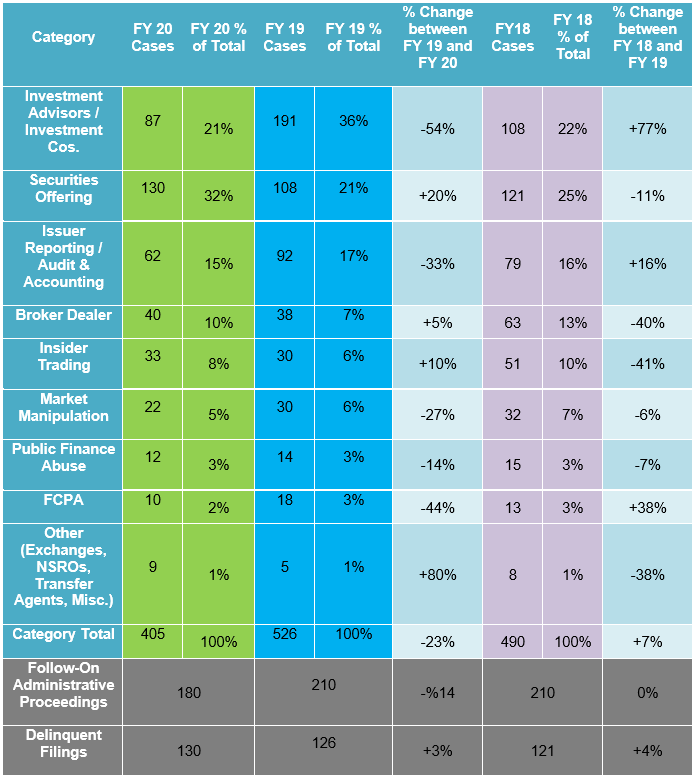

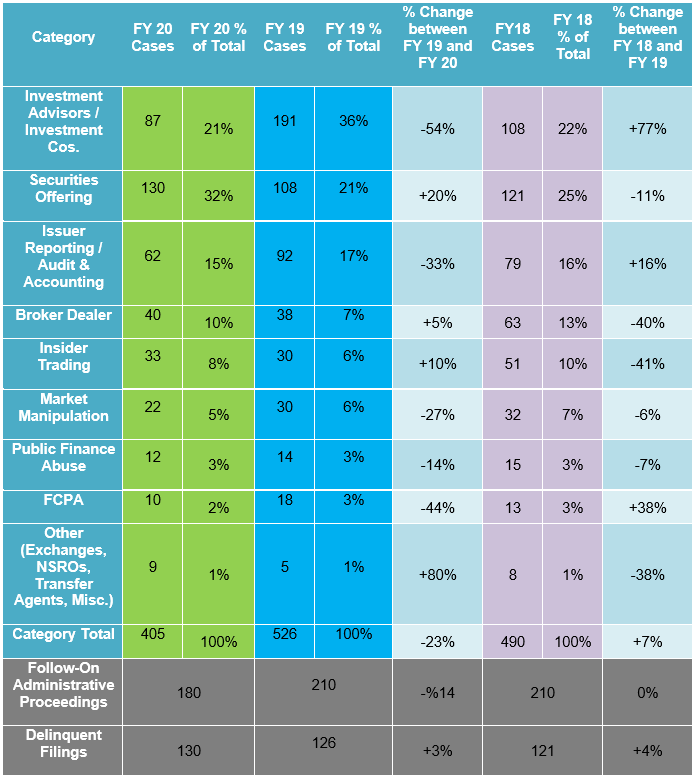

In the year just ended, the Commission brought 405 “stand-alone” cases, meaning civil actions filed or administrative proceedings instituted, excluding Section 12(j) proceedings against delinquent filers and follow-on administrative proceedings to obtain suspensions and bars based on prior enforcement actions by the SEC or other law enforcement agencies. Following the convention used in the Division of Enforcement’s own annual reports, we track these cases in nine different categories. The breakdown of these cases is as follows:

As the chart shows, there were some increases, but most categories reflect notable decreases in activity compared to last year.

III. The Clayton Tenure

A. Increased Securities Offerings Cases

There were at least 108 enforcement actions in the securities offering category in the three years for which Clayton was the chairman for the entire year. This category includes offering frauds, unregistered offerings, and actions related to cryptocurrency offerings, culminating in highs this year both in total (130 cases) and proportion (32% of all standalone actions). This is a notable increase both in volume and as a proportion of cases compared to the last full year of Mary Jo White’s tenure (FY 16), where such actions were just 16% of the total (90 overall) and the transition year of FY 17, where such actions were 21% of the total (94 overall). This reflects the Commission’s focus on protecting retail investors under Clayton, as many of the cases in this category are actions against individuals or entities that are targeting such investors. Further, the category encompasses several different types of schemes, including Ponzi schemes and initial coin offerings (“ICOs”) that generally implicate retail investors.

B. Continued FCPA Enforcement

Unlike the securities offering category, cases brought under the Foreign Corrupt Practices Act (“FCPA”) target multinational corporations and generally are among the highest-profile and recoup the largest financial recoveries of the cases the SEC brings. Commentators noted when Clayton was first selected to lead the SEC that he had been critical of FCPA enforcement, describing it as “too zealous.”[7] President Trump had also been critical of the law before taking office, describing it as “horrible.” Despite this, FCPA enforcement continued, with double-digit cases in all three of the Clayton-only years, and an average of about 14 cases per year, right in line with the 13 cases brought in the transition year, albeit slightly lower than the last year of White’s tenure, which preceded a turnover in leadership in the SEC’s FCPA Unit (21 cases).

C. Issuer Reporting / Audit & Accounting

The Issuer Reporting / Audit & Accounting category has also fluctuated during Clayton’s tenure, with a high of 92 cases (17% of the total) in FY 19 and a low this fiscal year of 62 cases (15% of the total). Such totals are down from the 95 cases (21% of the total) in the transition year of FY 17, although similar proportionally to the 93 cases (17% of the total) in FY 16, Chair White’s last full year.

IV. Other Noteworthy FY20 Enforcement Trends

A. Investment Advisors / Investment Companies

As we reported last year, about 17 percent of all stand-alone actions in FY 2019 came from the Commission’s “share class selection disclosure initiative,” which commenced in 2018 and encouraged investment advisers to self-report undisclosed conflicts of interest, to compensate investors, and to review and to correct fee disclosures.[8] Without the benefit of the initiative, Investment Advisers enforcement actions dropped by more than half in FY 2020 (87 compared to 191).

Despite the significant drop in Investment Adviser cases in 2020, two of the five largest civil penalties the SEC levied in FY 2020 were Investment Advisors cases. In one case, VALIC Financial Advisor, Inc. was charged in a pair of actions in July 2020 for a total monetary remedy of nearly $40 million.[9] The Commission found that VFA, which was the “preferred financial services partner” of Florida teachers unions, used three of its full-time employees to serve as “member benefit coordinators” who referred the teachers to VFA for investment recommendations while deceptively presenting themselves as employees of an entity owned by teachers unions. In the other action, the SEC charged VFA for making false and misleading statements about, and otherwise failing to disclose conflicts related to its receipt of millions of dollars of financial benefits from client mutual fund investments. As is usual in SEC settlements, VFA neither admitted nor denied the SEC’s allegations.

B. Crypto

Chairman Jay Clayton’s tenure may be most remembered for his agency’s response to the rise of cryptocurrency. In a mid-September 2020 speech, Chairman Clayton noted that the amount raised in token offerings fell from $20 billion in 2018 to $7 billion in the first ten months of 2019[10] as the SEC has cracked down on initial coin offerings. Perhaps reflecting this decline, the Commission brought 13 so-called “cryptocurrency” cases in FY 2020; this was a decrease from the 18 such cases we counted last year. Only time will tell if Chairman Clayton is ultimately perceived as an effective enforcer successfully tamping down on unregistered and fraudulent cryptocurrency offerings or a heavy hand hampering the innovation to financial markets and corporate America brought by blockchain technology.

In the largest recovery of FY 2020, the messaging app Telegram settled with the Commission for its alleged unregistered offering of digital tokens, agreeing to return $1.2 billion to investors and to pay an $18.5 million civil penalty.[11] Further, two crypto cases involved celebrities (actor Steven Seagal[12] and rapper T.I.[13]), reflecting a concern about celebrity involvement in unregistered ICOs that the Commission warned about in 2017.[14]

C. Insider Trading

After dropping to the lowest level of enforcement since the 1990s in 2019,[15] insider trading cases increased by 10% — from 30 to 33 — from FY19 to FY20. Only one of those cases — in which two executives at PetMed Express, a publicly traded online pet pharmacy, traded ahead of an earnings announcement — resulted in a recovery of more than a million dollars.[16] This figure is still below the 45 insider trading cases reported in FY 2016, the last full year before Chairman Clayton took over as head of the Commission.[17] In the intervening years, the number of cases peaked at 51 in FY18, Clayton’s first full year as Chairman, before dropping dramatically last year and staying low this year.

As discussed further below, the Supreme Court’s decision in Liu v. SEC, 140 S.Ct. 1936 (2020) has hampered the SEC’s ability to seek disgorgement. After Liu was decided on June 22, the first three insider trading cases the Commission brought included disgorgement as part of the remedy. Since then, however, only two of the last 13 insider trading cases brought in FY 2020 included disgorgement in the remedy, and neither of those involved recoveries of more than $15,000.

D. Specialized Units

As we explained in our FY 2018 year-end review, “[i]n addition to relying on ‘generalist’ enforcement personnel in its Headquarters and eleven regional offices that handle the full panoply of SEC cases, the Division also employs six specialized units to collect expertise on particular areas: the Asset Management Unit, the Complex Financial Instruments Unit, the Market Abuse Unit, the FCPA Unit, the Public Finance Abuse Unit, and the relatively new Cyber Unit.”[18]

To assess the productivity of these units in relation to the broader enforcement program in FY 2020, we counted the number of stand-alone enforcement cases that appear to have been primarily led by one of these units, rather than generalist staff. Importantly, though, the work of these units should not be evaluated only on a numerical basis, since the specialized skills that enforcement personnel assigned to them develop over time afford them the opportunity to pursue longer-term and more complex investigations. According to our data, about 17%, 69 of the year’s 405 cases were brought by these units, and the units were responsible for six cases with recoveries of more than $5 million. While this is less than last year’s proportions (163 of FY 2019’s 526 cases), those figures included 95 cases associated with the voluntary share class selection disclosure initiative. Taking those away, cases brought by specialized units are flat on an absolute basis (69 this year compared to 68 in FY 2019), and higher on a proportional basis.

V. Penalties and Recoveries

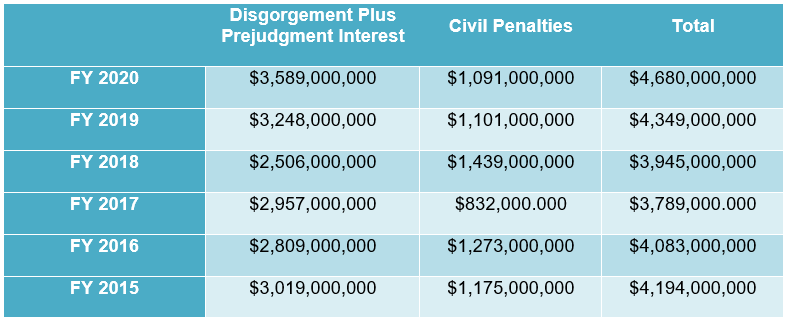

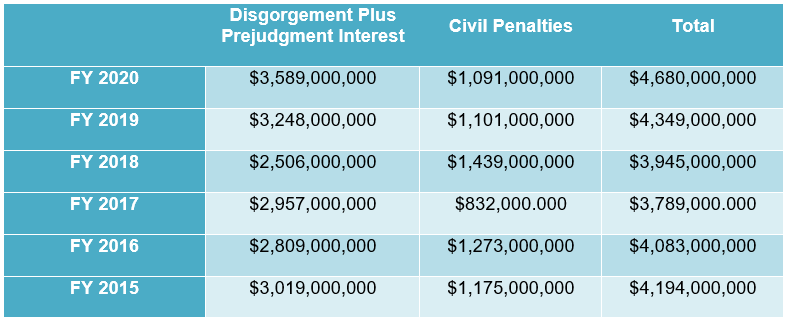

Despite the Commission’s misgivings about statistics, we are confident that the amount of monetary recoveries recovered will continue to play a key role in both internal and external assessments of the Commission’s success each year. In its annual reports, the Commission disclosed the following monetary recoveries for the Commission in the past six fiscal years:

This year, the Commission’s largest claimed recovery involved Telegram returning $1.2 billion to investors into its ICO.

Another large recovery ($455 million) was levied against Aequitas Management LLC, in relation to allegations that the company represented that it was making investments into health care, education, and transportation-related investments when the money was actually being used in a last-ditch effort to save the firm, and some money from new investors was allegedly used to pay earlier investors.[19]

Generally, the Commission was more reliant on big cases this year to make up the numbers for monetary recoveries. According to the Annual Report, the top 5 percent of cases in FY20 accounted for 81% of all monetary recoveries, the highest such total in the six-year period for which we have the data. In the previous five years, that number fluctuated between 67 percent–77 percent. Looking forward, while monetary remedies as a whole may continue to rise once a Chairman appointed by President-Elect Biden takes the helm of the SEC, disgorgement may decrease in the coming years due to the combination of the decisions in Kokesh v. SEC[20] and Liu v. SEC.[21] In Kokesh, the Supreme Court held that a disgorgement remedy amounts to a penalty and is therefore subject to a five-year statute of limitations, and in Liu, the Court clarified that a disgorgement award that does not exceed a wrongdoer’s net profits and is awarded for victims is equitable relief permissible under 15 U.S.C. § 78u(d)(5). Following Liu, the Commission may also be limited to seeking from tippers in insider trading cases only profits that they actually receive, such as in the form of a kickback from a tippee.

VI. Progress on Key SEC Priorities

A. Individual Accountability

As in years past, the Division of Enforcement emphasized “individual accountability” in its Fiscal Year 2020 Annual Report. As the Division explained in the annual report, “[h]olding individuals accountable is among the Commission’s most effective methods of achieving deterrence. Experience teaches that individual accountability drives behavior and can also broadly impact corporate culture.”[22] In FY 2017, the Division reported charging individuals in 73% of filed cases, and in FY 2018, that number stayed more or less the same, with 72% of cases including an individual in the case caption. After a significant drop in the proportion of cases against individuals to 57% in FY 2019, we count individuals in 71% of enforcement matters brought by the Commission, a proportion closer to usual norms.

The increase is most notable in the Investment Advisors / Investment Cos. category, where more than 56% of matters involved individuals in FY 2020 compared to FY 2019. However, the share class selection disclosure initiative, which accounted for nearly half of the Investment Advisor / Investment Cos. cases in FY 19, make comparing the categories year-over-year difficult. In addition, in the broker-dealer category, the percentage of cases involving individuals more than doubled from 25% in FY 2019 to more than 51% in FY 2020. The FCPA category held steady with three matters including individuals, which is the same total as last FY but higher as a proportion of FCPA cases.

One category where the proportion of matters involving individual defendants decreased is the Issuer Reporting / Audit & Accounting category, where the percentage of enforcement actions with individuals dropped from 67% to 56%.

As in past years, 100% of the Commission’s insider trading cases included individuals. In addition, market manipulation cases, where the vast majority of cases usually involve individual defendants, also had a 100% rate. Nearly all securities offering cases included individual defendants as well.

B. Protecting Retail Investors

In a September 2020 speech, Enforcement Co-Director Stephanie Avakian said that the Commission’s priorities under Chairman Clayton were “broadly speaking, to aggressively protect the everyday retail investor and preserve the integrity of our markets,” citing the Commissions efforts on Ponzi schemes and offering frauds specifically.[23] Both of those types of cases fall into the Securities Offering category, which was a rare category that saw an increase in enforcement action in FY 2020 compared to FY 2019. According to our count, the Commission brought 15 actions against alleged Ponzi schemes, — a dramatic increase from the six it brought last year according to our count — and all but one were contested in federal court, demonstrating the resource-intensiveness of these investigations. These actions included an alleged $330 million raised from mostly elderly investors that led to $26 million being misappropriated from more than 1,300 investors[24] and a “multi-year alternative energy tax credit Ponzi scheme” that raised more than $900 million.[25]

C. COVID-19

The World Health Organization designated COVID-19 a pandemic on March 11, 2020,[26] and President Trump declared it a national emergency on March 13.[27] Both co-directors of the Enforcement Division at the time, Stephanie Avakian and Steven Peikin, issued a statement on March 23 emphasizing that the pandemic “has impacted the securities markets in unprecedented ways.”[28] They stated that the Division “is committing substantial resources to ensuring that our Main Street investors are not victims of fraud or illegal practices in these unprecedented market and economic conditions.”[29] Although the SEC staff moved to remote work in early March, the agency repeated its usual pattern of accelerating the filing of enforcement actions in the second half of the agency’s fiscal year, which ended on September 30, 2020. Nearly two-thirds of the stand-alone actions, 269, came in the third and fourth quarter of 2020, when the staff was fully remote, including or nearly half, 188, in the fourth quarter.

Chairman Clayton highlighted the Commission’s prompt action in reacting to the economic vicissitudes brought on by the COVID-19 pandemic. The increased scrutiny of the Commission, joined by other law enforcement entities, like DOJ and from more than 13,000 tips,[30] likely brought some degree of order to the markets. The Commission brought six actions against individuals and companies the Commission alleged falsely promoted their abilities to provide essential services in the midst of the pandemic. For example, Sandy Steele Unlimited Inc., WOD Retail Solutions Inc., Bioscience Nutraceuticals, Inc., and Rivex Technology were all the subject of an emergency action in June because of an alleged microcap pump-and-dump scheme where promotional campaigns made false claims related to the pandemic (i.e. that Sandy Steel could produce medical quality face masks) while several individuals were dumping their shares.[31] In two other instances, two companies had trading suspended and were later charged for falsely saying they had testing ability. In one, Applied BioSciences issued a press release saying that it had finger-prick COVID tests.[32] In another, Turbo Global issued a press release falsely touting a “multi-national public-private-partnership” to sell thermal scanning equipment to detect individuals with fevers. Investigations into the use of CARES Act funds, insider trading, and other types of fraud or market abuse will likely increase once the in-coming Biden administration gets settled. Perhaps the most notable of these remains the joint probe by the DOJ and SEC into healthcare stock trades that Senator Richard Burr, having since stepped down from his post on the Senate Intelligence Committee, made in February.[33]

VII. Conclusion

Nominated on January 20, 2017, and confirmed a few months later, Chairman Jay Clayton directed the SEC to focus on the dual goals of protecting mainstream retail investors and modernizing the Commission. In service to the first objective, the Commission launched a number of initiatives during Clayton’s tenure, including the establishment of the Retail Strategy Task Force, which started in 2017 and conducted numerous educational programs, among other things, with vulnerable investor populations on detecting fraud;[34] the Share Class Selection Disclosure Initiative, which started in 2018 and concluded in 2020 and resulted in the return of $139 million;[35] and the COVID-19 Steering Committee, which first convened in March 2020 to coordinate the Commission’s investigative response to fraud propelled by the pandemic.[36]

In an effort to modernize the SEC, Clayton oversaw the formation of a Cyber Unit[37] and the Enforcement Division’s broad use of proactive, risk-based data analytics to aid it in securities offering fraud and insider trading cases. In the former, ICOs, specialized offerings predicated on the movement of digital assets, emerged as probably some of the most visible use-cases for the Cyber Unit’s unique focus and expertise. And in the latter, insider trading enforcement actions likely benefited--and should continue to benefit--from finer investigative tools even when the largely judge-made law in the area shifts. Along with the greater and more recent attention given to distortions in non-GAAP metrics and key performance indicators,[38] the Commission will likely continue its modernizing trend and supplement its traditional detection tools with advanced data analytics. This may result in some truly novel law enforcement techniques in the long-term, including the potential development of AI to study market patterns for unlawful activity.

With the unusual dip in FY 20 enforcement activity, which was not solely caused by the COVID-19 pandemic of 2020, the SEC under Chairman Clayton closed this presidential administration with some of the lowest enforcement totals. It was, however, efficient in collecting more recoveries than the Commission under Chair White and in pursuing more securities offering cases, including ICOs. As a function of these twin efficiencies, Clayton’s SEC met the goals that it set out for itself, returning noteworthy sums to retail investors and updating its cyber capabilities. The focus on retail investors through Claytons chairmanship remained a driving force in the Commission’s work in securities offering and investment advisor cases while the enduring priority of individual accountability paved the way for a familiar set of insider trading and market manipulation cases as well.

[4] Stephanie Avakian, Protecting Everyday Investors and Preserving Market Integrity: The SEC’s Division of Enforcement, SEC (Sept. 17, 2020), https://www.sec.gov/news/speech/avakian-protecting-everyday-investors-091720.

[5] Clayton’s tenure began on May 4, 2017, while White’s began on April 10, 2013, making the length of their tenures slightly different.

[9]In the Matter of VALIC Fin. Advisors, Inc., SEC Admin. Proceeding No. 3-19894 (Jul. 28, 2020); In the Matter of VALIC Fin. Advisors, Inc., SEC Admin. Proceeding No. 3-19895 (Jul. 28, 2020).

[14] In addition, the Commission won a summary judgment motion on September 30, 2020 against Kik, a messaging app, finding that the company’s initial coin offering, which raised $100 million, violated securities laws. In October 2020, the court entered a final judgment requiring Kik to pay, inter alia, a $5 million penalty. SEC Obtains Final Judgment Against Kik Interactive for Unregistered Offering, SEC Press Release (Oct. 21, 2020), https://www.sec.gov/news/press-release/2020-262.

[20] 137 S.Ct. 1635 (2017).

[21] 140 S.Ct. 1936 (2020).

Back

Back