Due to a dramatic increase in administrative proceedings against investment advisers, combined with a noticeable increase in issuer reporting / audit and accounting cases, the Securities and Exchange Commission ended Fiscal Year 2019 with a slight increase in enforcement activity compared to 2018. Absent the results of its share class selection disclosure initiative, however, the Commission’s enforcement activity appears to have declined compared to last year.

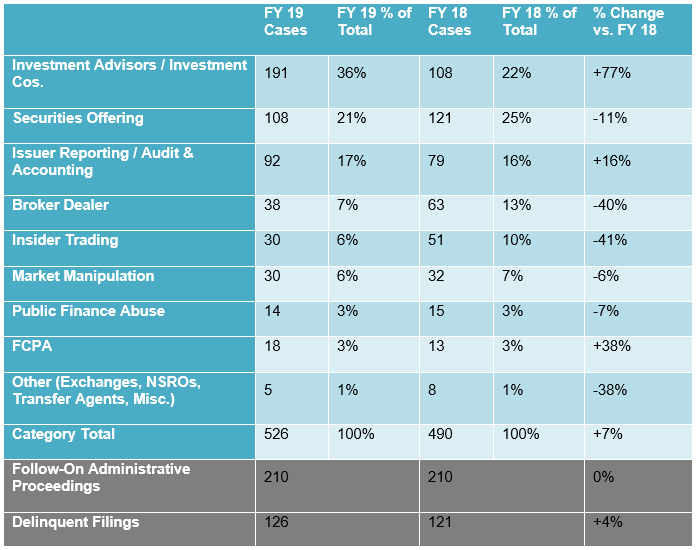

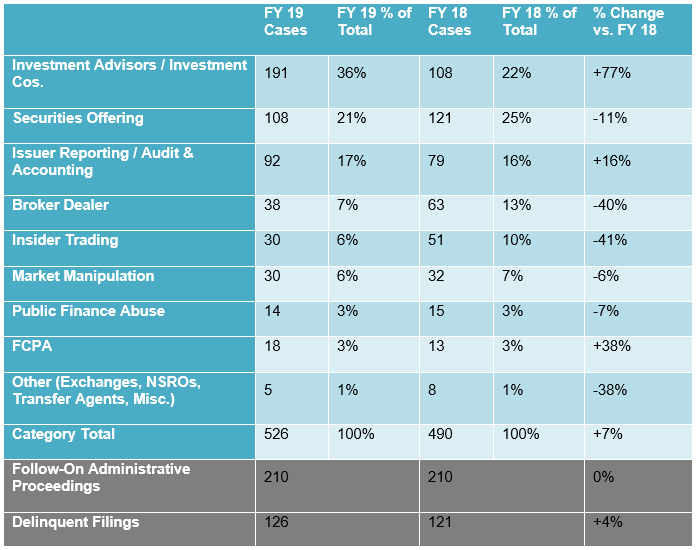

According to the Division of Enforcement’s FY 2019 Annual Report and our own calculations, the Commission brought 526 “stand-alone” cases compared to 490 such cases last year. This amounts to about a 7% increase in enforcement matters over FY 2018, excluding delinquent filing cases and administrative follow-on cases.

The Commission has historically resisted too great a focus on these annual metrics. As recently as September 2019, Co-Director of Enforcement Steven Peikin observed that “we at the Commission are going to hear a lot of questions about FY 2019, and many of them will relate to the Division’s statistics,” but that “statistics are a poor proxy for the quality and effectiveness of our efforts,” and “judging our work primarily through the lens of statistics can not only be misleading, but also counterproductive – incentivizing the wrong sorts of behaviors.” Nevertheless, measured by the number of actions filed, the Commission appears to have increased its output compared to FY 2018, just as it did in FY 2018 compared to FY 2017.

2019 Enforcement Results

In the year just ended, the Commission brought 526 “stand-alone” cases, meaning civil actions filed or administrative proceedings instituted, excluding Section 12(j) proceedings against delinquent filers and follow-on administrative proceedings to obtain suspensions and bars based on prior enforcement actions by the SEC or other law enforcement agencies. Following the convention used in the Division of Enforcement’s own annual reports, we track these cases in nine different categories. The breakdown of these cases is as follows:

As the chart shows, among these case categories, there were both significant increases and notable decreases in activity compared to last year. Despite the overall increase, enforcement cases in six of nine categorized areas actually declined compared to last year. Besides the significant increase in investment advisor activity, Foreign Corrupt Practices Act (“FCPA”) enforcement also increased from last year with 18 such cases brought this year as compared to 13 in 2018.

Noteworthy Enforcement Trends

Investment Advisors

About seventeen percent of all stand-alone actions in FY 2019 came from the Commission’s “share class selection disclosure initiative,” which, as we described at the half-year mark, encouraged self-reporting by an investment adviser that purportedly failed to disclosure conflicts of interest associated with its selection of mutual fund share classes paying Rule 12b-1 fees when a lower-cost share class for the same fund was available to clients. For those investment advisers participating in the self-reporting initiative, the Commission limited its charges to violations of Sections 206(2) and, in some cases, Section 207 of the Investment Advisers Act of 1940. The Commission also agreed not to require payment of civil penalties from initiative participants. On just two days — March 11, 2019 and September 30, 2019 — the Commission announced 95 such settlements. Had it not been for these voluntary disclosures, the Commission would have brought just 431 substantive cases, or about 12% fewer than in FY 2018.

Apart from the self-disclosure initiative, the Commission’s remaining investment adviser cases were generally not among the year’s most significant matters. For example, only six appear to have involved civil penalties over $1 million, with the largest being a settlement with State Street Bank in which the Commission found that between 1998 and 2015, the Bank over-charged its mutual fund clients and other registered investment companies for reimbursable expenses, including about a $110 million markup on SWIFT message fees over that time period. (State Street did not admit or deny the findings.)

Issuer Reporting / Audit and Accounting

The Commission reported an uptick in enforcement activity focused on issuer reporting, auditors, and accounting in FY 2019, bringing 92 cases compared to 79 such cases in FY 2018. As we described at the half-year mark, the internal controls and audit-related activity included the results of a small “internal controls sweep,” in which the Enforcement Division pursued allegedly longstanding internal controls failures, including by CytoDyn Inc., Digital Turbine, Inc., Grupo Simec S.A.B. de C.V., and Lifeway Foods, Inc. It also included a small “sweep” of cases involving alleged failures to disclose that required quarterly reviews by external auditors had not occurred.

The Commission’s accounting activity included an action against Mylan M.V., which, as described in a prior Covington Alert, involved the alleged failure to disclose loss contingencies concerning a pending government investigation and related failures to disclose risk factors, as well as a more recent action against The Bancorp, Inc., for alleged failures to identify loan impairments and credit deterioration in its loan portfolio, among other purported accounting deficiencies.

Finally, the Commission brought a number of corporate disclosure actions in FY 2019. These included actions against Marvell Technology Group, Ltd., for engaging in an alleged “revenue management scheme,” and against Nissan Motor Co., Ltd. and its former CEO and a former director for failing to disclose $140 million in planned retirement compensation to the former CEO.

Cryptocurrency

Nested within the “securities offering” category above, the Commission also brought 18 so-called “cryptocurrency” cases in FY 2019; this was a notable increase from the nine such cases we counted last year. Ten of these cases involved an initial coin offering directly or indirectly, suggesting that the Commission is continuing to monitor the risks to investors of unregistered cryptocurrency offerings, or potential fraud in connection with such offerings.

Between the beginning of January 2019 until July 8, 2019, the approximately six months during the fiscal year when the SEC had only four commissioners, the Commission brought just three of these 18 cryptocurrency cases, perhaps owing to the less-than-universal support for aggressive enforcement in this burgeoning area. As the Wall Street Journal has reported, for example, Commission Hester Peirce “has often questioned whether defendants understood how their [cryptocurrency] token sale might be deemed a security,” and also “disputed the SEC’s basis for rejecting” an exchange-traded fund designed to track cryptocurrency assets. Among the cases the SEC did settle in this area, the recoveries generally were under a half-million dollars, with just two cases involving significant recoveries — one against Bitqyck, Inc., with $9.3 million in disgorgement, and one against Block.one, with a $24 million civil penalty.

Summarizing its enforcement work in the digital asset space in FY 2019, the Commission explained: “Collectively, these actions send the clear message that, if a product is a security, regardless of the label attached to it, those who issue, promote, or provide a platform for buying and selling that security must comply with the investor protection requirements of the federal securities laws.”

Securities Offerings

Although securities offering cases declined by about 11% compared to FY 2018, this category includes a broad array of cases, including cryptocurrency cases, EB-5 visa fraud, securities offering fraud, and unregistered offerings. One subcategory, in particular, appears to track the Commission’s ongoing focus on securities law violations that harm retail investors.

According to a recent New York Times analysis, the Commission has significantly increased the number of enforcement actions targeting “Ponzi schemes” in the decade since the collapse of Bernard Madoff’s investment company, with an increasing number of these actions involving “esoteric investments like natural resource mining and cryptocurrencies.” The Commission generally categorizes these actions as offering frauds (which are consolidated, along with other kinds of actions, into the “securities offering” category in the table above). The Commission’s Ponzi scheme enforcement actions in FY 2019 demonstrate the resource-intensiveness of these investigations, given that all six of the actions we identified as Ponzi schemes last year were filed as contested federal court actions, requiring the Commission to devote litigation resources to them. These actions included an alleged $19.6 million scheme aimed at “a target audience of retired Christian investors”; an alleged $25 million scheme “promising high annual returns with minimal to no risk to investors in the Vietnamese community of Orange County, California”; and an alleged scheme involving “fraudulently raising at least $1.2 billion from more than 8,400 retail investors, many of them seniors.”

In total, the SEC filed 108 new actions in FY 2019 against alleged fraudulent securities offerings, requiring a significant investment in litigation resources to handle these matters.

FCPA

At the outset of the current administration, many reasonably wondered whether FCPA enforcement — for the last decade, a significant and growing area of focus for both the Justice Department and the SEC — might decline. Such predictions were grounded in President Trump’s referring to the Act as a “horrible law” that disadvantaged U.S. companies and should be changed. In a September 2019 speech to the Economic Club of New York, Chairman Clayton lamented that “[w]e should, however, recognize that we are acting largely alone and other countries are incentivized to play, and I believe some are in fact playing, strategies that take advantage of our laudable efforts,” noting “the FCPA-driven withdrawal of U.S. and U.S.-listed firms from certain jurisdictions, illustrates that globally-oriented laws, with no, limited or asymmetric enforcement, can produce individually unfair and collectively suboptimal results.” Nevertheless, FCPA enforcement has continued unabated, with nearly 80 FCPA cases brought in the past five years alone.

Most recently, in FY 2018, the Commission brought 13 FCPA enforcement cases, the same number that it did in FY 2017, though fewer than the high watermark in FY 2016 of 21 such cases. In FY 2019, FCPA enforcement has increased, with the Commission bringing 18 new cases with substantial associated recoveries. Collectively, these matters — all of which were announced as settled — involved about $350 million in disgorgement, $51 million in pre-judgment interest, and $136 million in civil penalties.

Specialized Units

As we explained in our FY 2018 year-end review, “[i]n addition to relying on ‘generalist’ enforcement personnel in its Headquarters and eleven regional offices that handle the full panoply of SEC cases, the Commission also employs six specialized units to collect expertise on particular areas: the Asset Management Unit, the Complex Financial Instruments Unit, the Market Abuse Unit, the FCPA Unit, the Public Finance Abuse Unit, and the newly minted Cyber Unit.”

To assess the productivity of these units in relation to the broader enforcement program in FY 2019, we counted the number of stand-alone enforcement cases that appear to have been primarily led by one of these units, rather than generalist staff. Importantly, though, the work of these units should not be evaluated only on a numerical basis, since the specialized skills that enforcement personnel assigned to them develop over time afford them the opportunity to pursue longer-term and more complex investigations. According to our data, 163 of the year’s 526 cases were brought by these units, with the vast majority — 102 — led by the Asset Management Unit, thanks mostly (though not entirely) to its role in the share class selection disclosure initiative. Excluding the 95 cases associated with that voluntary disclosure initiative, however, all of the specialized units combined brought only 68 cases, or just 13% of the year’s cases. Just 11 of these cases appear to have been brought primarily by the Enforcement Division’s Market Abuse Unit, suggesting that the diversion of this unit’s personnel to the Division’s new cryptocurrency initiative may be eroding the volume of cases it is able to investigate and file. Given customary resource constraints, the Commission will likely consider whether their enforcement activity generated by some of these units — such as the Cyber Unit, which was created in 2018 and appears to have brought just eight cases in FY 2019 and only two since February — continue to justify the staff commitment necessary to maintain them.

Settlements

Of the 526 stand-alone cases filed in FY 2019, we calculate that 373 were fully settled at the time of filing. That leaves 153 cases fully or partially unresolved at filing. (The Commission itself reports a similar result, noting in its Annual Report that “[o]ver 30% of the standalone matters the Division brought in Fiscal Year 2019 were filed in whole or in part as litigated actions.”) By contrast, based on New York Times data from Fiscal Year 2018, the Commission appears to have filed about 167 un-settled stand-alone actions.

Of the 153 cases filed without a full settlement in FY 2019, 65 appear to be securities offering cases, including EB-5 visa fraud, offering fraud, crypto, and unregistered offering cases. That makes up 42% of all un-settled cases, or about twice the representation of securities offering cases in the Commission’s overall body of enforcement work last year. Just 43 of the Commission’s 108 FY 2019 securities offering cases (or about 40%) were filed as completely settled, suggesting that the Commission’s litigators will be devoting substantial resources to pursuing these cases.

Penalties and Recoveries

Despite the Commission’s misgivings about statistics, we are confident that the amount of monetary recoveries recovered will continue to play a key role in both internal and external assessments of the Commission’s success each year. That said, accurately assessing the amount of money recovered in SEC enforcement actions is not straightforward. For example, in its Fiscal Year 2018 report, the Division of Enforcement acknowledged that “[a] significant amount of the money ordered in FY 2018 came from a single case,” referring to the Petrobas FCPA matter, in which the Commission claimed $1.018 billion in disgorgement, prejudgment interest, and civil penalties, even though all but about $85 million was deemed satisfied by civil and criminal payments to other regulators and governments. This year, the Commission’s largest claimed recovery, totaling $1 billion, involves an alleged Ponzi scheme by the Woodbridge Group of Companies LLC, in which the largest portion of the recovery — $892 million in disgorgement by Woodbridge and various corporate affiliates — is deemed satisfied by the bankrupt entity’s liquidation trust distributing any recovered assets to investors, a remedial scheme that appears unlikely to distribute the full amount of disgorgement ordered. Correcting for these variations is difficult, and different analysts have adopted approaches resulting in smaller recoveries attributable to the SEC.

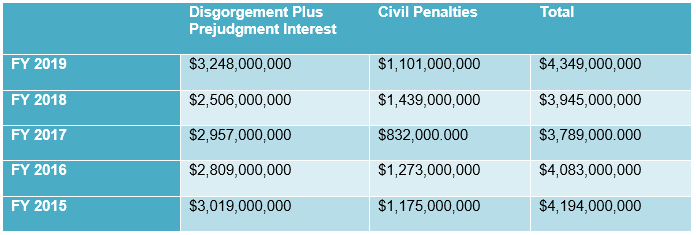

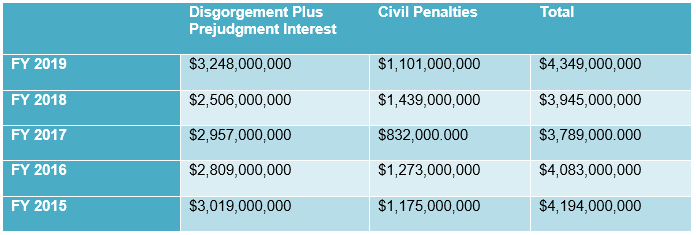

Notwithstanding these caveats, the Commission calculated the following recoveries for the Commission in FY 2019:

Although these reported totals mark a noticeable 10% increase in claimed recoveries compared to FY 2018, they are heavily dependent on the Woodbridge matter and its uncertain disgorgement total. Absent that matter, the Commission’s recoveries actually would have declined compared to FY 2018, despite the increase in enforcement volume.

Aside from the Woodbridge matter, it appears that, as in prior years, two of the Commission’s largest disgorgement recoveries both involved FCPA resolutions: one against Fresenius Medical Care AG, which ordered $135 million in disgorgement, and one against Walmart Inc., which ordered about $120 million in disgorgement. One of the year’s largest civil penalties likewise involved an FCPA resolution, with Mobile TeleSystems PJSC required to pay $100 million in civil penalties.

The SEC’s healthy recoveries in FY 2019 may belie somewhat the Co-Directors’ often-stated concerns, expressed once again in their most recent Annual Report, that the Supreme Court’s decision in Koksesh v. SEC “continues to impact adversely the Commission’s ability to disgorge and return funds to investors injured by long-running frauds, such as Ponzi schemes, that often directly impact retail investors.” Kokesh held that disgorgement operates as a penalty for purposes of the statute of limitations and was thus subject to the same statute of limitations as the Commission’s authority to collect civil penalties. The Report estimates that the Commission has had to forego “approximately $1.1 billion dollars [sic] in disgorgement in filed cases.” Likely more concerning to the Commission on this front, however, is the Supreme Court’s recent grant of certiorari, on November 1, 2019, in Liu v. SEC, 18-1501, an appeal from the Ninth Circuit which challenges the Commission’s authority to seek disgorgement in all district court cases, a question left open in Kokesh. If the defendant in Liu succeeds before the Court, and absent a change in law, the Division could be confined to seeking disgorgement in its administrative tribunal, a forum that has confronted its own legal challenges in recent years. Such a result could lead to future decreases in monetary recoveries.

Four- v. Five-Member Commission

The SEC spent approximately half of FY 2019 with only four commissioners, as Commissioner Kara Stein left the agency on January 2, 2019, and her replacement, Allison Lee, was not sworn in until July 8, 2019. Perhaps as a result, the number of actions brought in this period in the middle half of FY 2019, when the Commission had only four Commissioners, was somewhat lower — 229, as opposed to 297 actions brought when there were five Commissioners. The number is starker when excluding Investment Advisors actions. The SEC brought 79 such actions under the share class selection disclosure initiative on March 11, meaning that just 150 cases were brought outside of this voluntary-disclosure initiative during the period when there were only four commissioners.

All classes of cases saw fewer actions approved by the four-member Commission as compared to the period with five members. For example, only 9 of the 30 market manipulation actions were brought while the Commission had four members. Similarly, only 8 of the 38 broker-dealer actions and 6 of the 18 FCPA actions were approved by the smaller Commission. This pattern, however, also could be explained by the fact that the end of the fiscal year, when the Commission brings a disproportionate number of its enforcement actions, saw the return of five Commissioners. That was certainly true this year: the Commission brought 215 cases in the last quarter of FY 2019, or 41% of the entire year’s cases.

Progress on Key SEC Priorities

Protecting retail investors

The Division of Enforcement’s 2018 Annual Report notes that “[t]he Commission places a significant priority on returning funds to harmed investors whenever possible.” Cases against investment advisors/investment companies are up, and make up about 36% of total actions, up from 22% in FY 2018.

In an April 2019 speech, Office of Compliance Inspections and Examinations Director Peter Driscoll noted that “in 2019, our examination priorities include several areas that OCIE believes serve to protect retail investors, particularly seniors and those saving for retirement,” including “(1) fees, expenses, and related disclosures; (2) the safeguarding of client assets; (3) undisclosed conflicts of interests; (4) firms borrowing from clients; and (5) the protection of seniors.”

As described above, the largest reason for the numerical increase in retail-oriented cases was the voluntary reporting induced by the share class selection disclosure initiative. Assuming that investment advisers complied with the program’s voluntary-disclosure specifications, however, the defendants in these consumer-focused actions did not face civil penalties.

One case that fits within the focus described by the OCIE Director is the Commission’s action against BMO Harris Financial Advisors in September. The Commission accused BMO Harris of failing to disclose conflicts of interest in its retail investment advisory program, known as the Managed Asset Allocation Program, or “MAAP.” BMO Harris allegedly invested half of MAAP assets in its own proprietary mutual funds without surveying the market to determine whether they were most suitable for the program, and without disclosing to investors that lower-cost share classes were available for the same fund. As a result, BMO Harris agreed to pay $29.7 million in disgorgement and prejudgment interest, as well as an $8.25 million penalty.

There were no other recoveries of more than $10 million dollars in retail-focused actions against registered investment advisors.

Individual Accountability

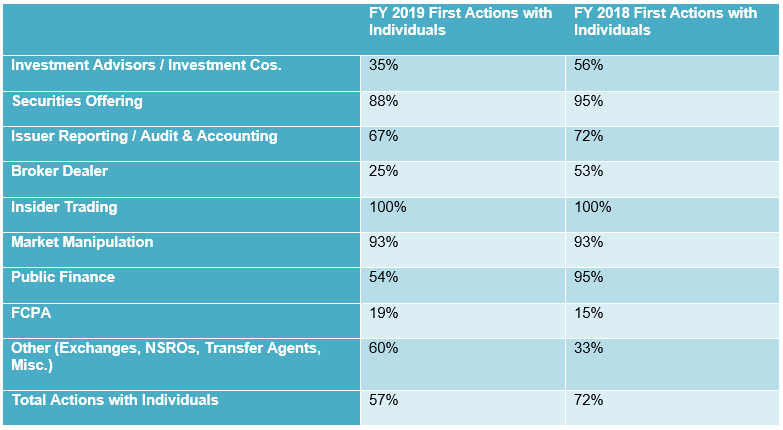

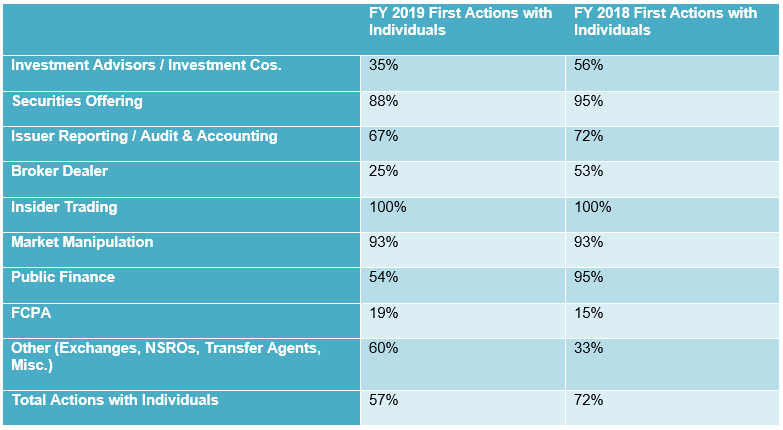

Each year, the Division of Enforcement emphasizes the “individual accountability” that comes from its enforcement actions. As the Division explained in its Fiscal Year 2018 Annual Report, “[i]ndividual accountability is critical to an effective enforcement program and is one of the core principles of the Division of Enforcement.” It listed individual accountability as one of “five principles that would guide the Division’s assessment of its performance,” and noted its success in maintaining a consistent rate of individual accountability over the past two years. In FY 2017, the Division reported charging individuals in 73% of filed cases, and in FY 2018, that number stayed more or less the same, with 72% of cases including an individual in the case caption.

Whereas the Commission had charged individuals in close to three-quarters of its cases over the last two years, in FY 2019, we count individuals in just 57% of the enforcement matters brought by the Commission. As the Commission hastens to emphasize in its Annual Report, however, “69% of the Commission’s standalone actions, excluding actions brought as part of the Share Class Initiative (which applied only to entities), involved charges against one or more individuals.” (Indeed, dropping those 95 voluntary-disclosure cases from the denominator in our own data, we get a 71% rate of individual accountability.) Excluding these cases for the purposes of individual accountability is somewhat self-serving, given the important role the initiative played in the Commission’s overall results. The decline in individual accountability is most notable in the areas with a high overall number of cases. For example, only about a third of investment adviser cases charged an individual, whereas more than half of these cases charged an individual in FY 2018. This once again owes to the share class selection disclosure initiative, in which the Commission brought a significant number of cases against investment advisers, but without charging individuals.

Other categories are more surprising. For example, the broker dealer category, which was also down overall compared to FY 2018, included individuals in under one-third of the cases brought, compared to over half of the cases last year. As our data in the chart below reflect, the decline in actions against individuals in other areas have been quite significant.

As in past years, 100% of the Commission’s insider trading cases included individuals. Nearly all securities offering cases, and the vast majority of market manipulation cases, included individual defendants as well. Indeed, although there were relatively few such cases overall, the Commission actually increased its rate of individual accountability in FCPA matters—the only case category reflecting any increase at all.

Given the Division of Enforcement’s emphasis on this metric as a key measure of its success in focusing on “Main Street” priorities, we expect discussion about this trend during the coming year.

Conclusion

Based on its top-line results, the Commission kept pace with its level of enforcement activity from FY 2018, relying heavily on a voluntary-disclosure initiative. Still, even despite noticeable increases in other areas, such as in issuer reporting / audit and accounting cases, absent the investment advisers initiative, the Commission’s activity would have declined substantially this year. The Commission also appears to have charged meaningfully fewer individuals with violations of the securities laws compared to the prior year, marking a break with one of its own repeatedly identified priorities.

Back

Back